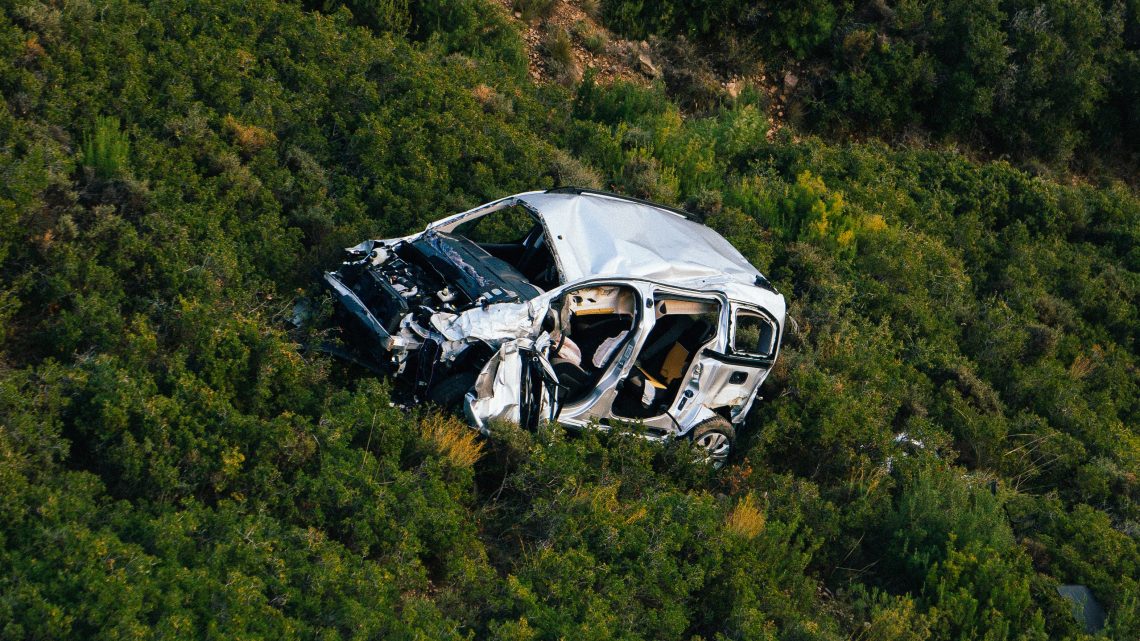

California, with its many cities and expansive road networks, is a state where car accidents are unfortunately all too common. To safeguard yourself and others on the road, it’s crucial to understand California’s car insurance laws, including the minimum coverage requirements and their impact on accident claims. Additionally, in the event of an accident, speaking to an Encino car accident lawyer can be a wise decision to navigate the complex legal landscape. In this blog, we’ll explore these aspects in detail.

Minimum Coverage Requirements

California law mandates that all drivers carry a minimum level of auto insurance coverage. The primary purpose of these minimum requirements is to ensure that if you are at fault in an accident, you have the financial means to compensate the other party for their losses, including medical bills and property damage.

According to the California Department of Motor Vehicles as of September 2021, the minimum coverage requirements in California included:

- Bodily Injury Liability Coverage: You must have a minimum of $15,000 per person and $30,000 per accident. This coverage helps pay for the medical expenses and other related costs of people injured in an accident for which you are at fault.

- Property Damage Liability Coverage: You must have a minimum of $5,000. This covers the repair or replacement of the other party’s property, such as their vehicle or other damaged property.

- Uninsured/Underinsured Motorist Coverage: Although not required, California law strongly recommends carrying uninsured and underinsured motorist coverage. This coverage helps protect you in case you are in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Impact on Accident Claims

Understanding these coverage requirements is vital because they have a direct impact on how accident claims are processed. When you’re in an accident in California, the at-fault party’s insurance is typically responsible for covering your losses. If you’re the one at fault, your insurance is responsible for covering the losses of the other party.

If the at-fault party is uninsured or underinsured and you have uninsured/underinsured motorist coverage, your own insurance can step in to cover your expenses. This makes it especially important to consider this optional coverage, as many drivers in California either have inadequate insurance or none at all.

However, even with insurance, the process of filing and managing a claim can be complex. Insurance companies often seek to minimize their payouts, and negotiating a fair settlement can be challenging, especially if you’re dealing with medical bills, vehicle repairs, and lost wages following an accident.

Why You Might Need a Car Accident Lawyer

This is where a car accident lawyer can be your best ally. They specialize in personal injury law and are well-versed in the intricacies of California’s insurance laws. Here’s how they can assist you:

- Legal Expertise: A car accident lawyer has in-depth knowledge of California’s car insurance laws, ensuring that you receive the maximum compensation you are entitled to.

- Claim Handling: They can handle all the paperwork, negotiations, and communication with insurance companies, leaving you with less stress and more time to focus on your recovery.

- Investigation: A skilled attorney will investigate the accident to determine liability, gather evidence, and work with experts, if needed, to build a strong case.

- Negotiation: Insurance companies often offer settlements that are far less than what you deserve. A car accident lawyer will negotiate on your behalf to secure a fair settlement.

- Litigation: If necessary, your attorney can take your case to court and represent your interests in front of a judge and jury.

- Personalized Guidance: Your lawyer will provide you with legal advice tailored to your specific case, ensuring that your rights are protected.

In addition to these practical benefits, many car accident lawyers offer free initial consultations, so you can discuss your case without any financial commitment.

Remember that, while this information is accurate as of my last update in September 2021, laws and regulations can change. To get the most up-to-date information and tailored advice, it’s always a good idea to consult with a car accident lawyer who practices in California.

In conclusion, understanding California’s car insurance laws, especially the minimum coverage requirements and their impact on accident claims, is crucial for anyone who gets behind the wheel in the Golden State. And should you ever find yourself in an accident, don’t hesitate to seek the assistance of a qualified car accident lawyer to navigate the legal complexities and ensure you receive the compensation you deserve. Your safety and financial well-being may depend on it.

No Comment