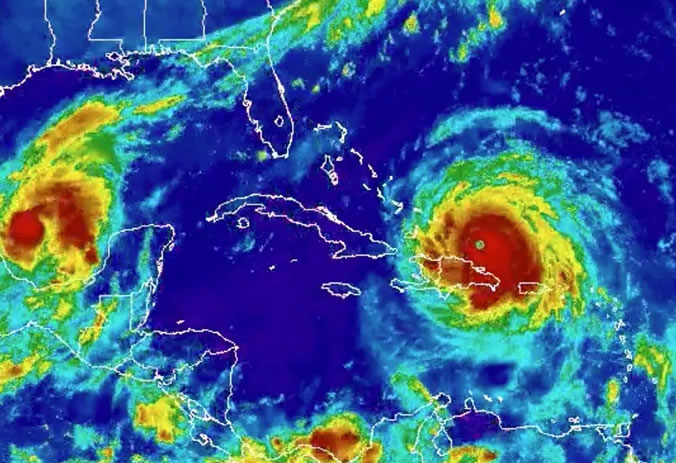

With the recent hurricanes in Texas and Florida, many of us are wondering how homeowners pick up the pieces after such devastation, and just how insurance companies will handle such situations to help them do that.

Home and business property owners need to treat insurance claims with utmost care in order to ensure the insurance claim process goes as quickly and smoothly as possible. We hope the following information will be helpful.

First Things First

Get yourself and everyone around you out of harm’s way. Even after the hurricane has passed, structural damage, water drainage, weakened roads, downed power lines or gas leaks, and electrical shortages can all be potential hazards, to name a few. Keep gas and electricity turned off if the building has been flooded until it has been inspected, and don’t drink water unless it is from a bottle or other safe source.

As soon as you know the extent of the damage to your home and property, contact your insurance agent right away. While not every type of damage may be covered by one policy, your agent should be able to help you in this area and to steer you in the right direction.

Take pictures/videos of any damaged property and keep notes and inventory lists for insurance adjusters before making any repairs. Be sure to document everything, including all communication (phone calls, emails, etc.) with your insurance company and any others you have contacted for help with repairs, temporary lodging, rental cars, etc.

Begin making temporary repairs to prevent further damage to your home and property. Cover broken windows or place tarps to prevent additional water intrusion in roofs, for example, until your insurance company can inspect the damage and send a licensed contractor out to you to make final repairs. Be sure to save all your receipts.

Beware of debris, broken glass, and other hazardous materials, especially what you may not be able to see beneath standing water. Wear protective gloves, clothing, and eyewear when necessary when cleaning up.

Allow your insurance company to inspect your home and, hopefully, make payment on your claim. Don’t accept their offer, however, if they are expecting you to find your own contractor and have it fixed yourself; have a licensed contractor come and give you an estimate first.

If you believe their offer is too low, a reputable contractor may be able to assist you with a proper and accurate value of your loss. You can submit the contractor’s estimate/proposal to the insurance company with a demand for a supplemental payment. If the company is still refusing to help you, you may have to hire an attorney.

A word of caution: Too many contractors have been known to prey on homeowners in the aftermath of a hurricane, so beware of these unscrupulous characters. Always ask for references, and use only licensed contractors. With that in mind, never assign over insurance benefits to third party contractors. Abuses include theft of insurance payouts, inflated charges, unfinished repairs, and long delays due to the resulting legal battles.

How an Attorney Can Help

Hurricanes can be among the most destructive forces in nature. Your insurance policy should offer you at least some peace of mind when it comes to picking up the pieces and repairing the damages. If you find that your insurance company is doing all it can to pay you as little as possible, or avoid paying altogether, you may need to contact an attorney for help.

While standard homeowners’ and renters’ policies typically cover wind damage, however, they do not cover flooding from ground water; for that, separate flood insurance coverage is required, so you may be fighting with more than one company. Either way, since insurance companies/adjusters are not in the business of paying out claims, they may be far too quick to attempt to apply exclusions under a policy that you actually have a right to. For that reason, it is wise to be familiar with your policy’s coverages and to follow some important steps when contacting your insurance carrier.

- Review your policy carefully so you know what is covered.

- If you decide to contact the insurance company yourself, do not agree to be recorded over the phone, especially if you are stressed and not thinking clearly. In other words, only provide a sworn statement under the direction of your attorney.

- Create a detailed list of everything lost or damaged.

- Document all damages with pictures and videos that are time stamped.

- Keep a log of contact with the insurance company, including names of who you spoke with, the nature of your conversation, etc.

- Keep original receipts of all your expenses.

If you believe you are being denied adequate, fair coverage under your insurance claim, contact us today. Remember that if you must hire a lawyer because an insurance company denied your claim, some states (i.e., Florida) are required to pay your attorney’s fees if you win the case. For that reason, it is always wise to consult with an attorney skilled in this area of the law to see if you have a case.

No Comment